Get a free Auto Insurance quote from 20+ insurers

Something that is quite straight forward for People often turns out to be more complicated for those who are new to Canada. Searching for auto insurance and getting a cheap car insurance policy is one such issue, but we are here to help. Here are some questions you need to answer and steps you need to take to get cheap car insurance if you are new to Canada.

Question #1: Where, and how long, do you plan to stay in Canada?

The provinces treat out-of-country driving licences differently – some can be converted into ones (meaning that Canada has a reciprocal licence exchange agreement with this country), while others cannot, meaning that you will need to pass a knowledge test and/or a road test.

If your driving licence originates from a country that has an agreement with Canada and can be converted into a licence, there is also the question of how long you can drive with your out-of-country driving licence before you have to convert it, and these times vary by province. Here are examples from Ontario, Alberta, and British Columbia:

Austria

Belgium

France

Germany

Great Britain

Isle of Man

Japan

Republic of Korea

Switzerland

Taiwan

New Zealand

Northern Ireland

Republic of Ireland

Austria (Class 5)

Belgium (Class 5)

France (Class 5)

Germany (Class 5)

Isle of Man (Class 5 & 6)

Japan (Class 5)

Republic of Korea (Class 5)

Switzerland (Class 5 & 6)

Taiwan (Class 5)

United Kingdom (Northern Ireland – Class 5 & 6)

United Kingdom (England, Scotland & Wales – Class 5)

United States (Class 5, 6 & 7)

Australia

France

Germany

Guernsey

Isle of Man, Jersey

Ireland

Japan

Netherlands (except former territories in Antilles)

New Zealand

South Korea (not motorcycles)

Switzerland

Taiwan (not motorcycles)

United Kingdom (includes England, Wales, Scotland and Northern Ireland)

United States (includes Washington DC and Puerto Rico)

* you need to have a valid home jurisdiction drivers licence and an International Drivers Permit (see here)

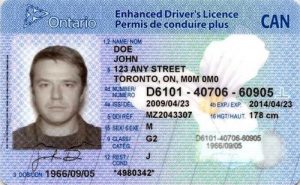

Question #2: What does the process of the licence exchange look like?

It is actually quite straight-forward. You bring your existing licence to one of the government locations, such as Service Alberta (in Alberta) or Service Ontario (in Ontario). You will get a driving licence and your existing, out-of-country licence will be taken away.

There might be some additional documents that you could be asked for, like proof that you have more than two years of driving experience.

Question #3: How to search for cheap car insurance?

Getting car insurance in Canada is similar to many other countries, unless you are located in one these three provinces: British Columbia (BC), Manitoba (MB) or Saskatchewan (SK). There is only one provider of car insurance in these provinces: the crown corporation (government corporation) – ICBC in BC, MPI in MB and SGI in SK.

In any other province, you can buy car insurance through an insurance broker or directly from an insurance company (or its agent).

The best way to compare the market quickly and find cheap car insurance is to use one of the online platforms that covers numerous insurance companies. Here are four that you should be considering (including InsurEye) due to the number of companies covered.

*These lists of companies (based on the website information in February 2017) relates to Ontario and can be different for other provinces

These providers offer you a quote online or somebody will contact you once you have left your contact data requesting a quote.

Is that all? Not really. We suggest checking the websites of more companies that are not often included in the aggregator search because they sell car insurance directly through their own contact centres or online:

- TD Insurance / Meloch Monnex (large insurer selling insurance online and via call center)

- Sonnet Insurance

- Belairdirect (large insurer selling insurance online and via call center)

- AMA (Western provinces only)

Once you have compared prices from both online aggregators and the insurers listed above, you are ready to purchase your policy. There is, though, another crucial point to pay attention to – I will tell you more about this in the next section.

Question #4: How will insurers treat a lack of driving experience in Canada?

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

- No consideration of your driving experience: Some insurers will accept the fact that you can buy car insurance (with a newly received driving licence) but will treat you like somebody who has just got a driving licence and has no driving experience. If you are a young driver in Ontario, your rates can reach $250-$350 per month – not a very attractive scenario!

- Consideration of your prior driving experience: Some companies will treat your former driving experience with respect and consideration when offering you an insurance policy and will give you a cheap insurance quote.Personal experience – when I moved to Canada, TD Insurance acknowledged my driving experience in Germany, and my rates were similar to those of other People even though I was new to the country. That situation can constantly change – so check with a few companies on how they would treat your case, or speak with an insurance broker.

Question #5: How can I reduce my car insurance rates even further?

There are many aspects that impact your auto insurance price and help you to get cheap car insurance. Some of them can be influenced by you (model of the car, for example), but other things are tied to aspects beyond your control, like your age and gender.

Considerations include:

Car make: All cars are different and come with various risk profiles (frequency of being stolen, chance of an accident, etc.). Here is a list of the least expensive top-selling cars to insure as per insuranceholtine.com:

- Volkswagen Jetta

- Volkswagen Golf

- Toyota Camry

- Hyundai Accent

- Chevrolet Cruze

- Mazda Mazda3

- Hyundai Elantra

- Honda Civic

- Toyota Corolla

- Ford Fusion

Make sure that, before you buy your dream car in Canada, you check insurance quotes for the model to avoid unpleasant surprises.

Proximity to work: The closer you work and the less distance you have to drive, the less risk you present in insurers eyes; this leads to lower premiums.

Storing your car in a private garage sometimes means a lower premium than if you park on the street. If you buy a house or condo, make sure that it comes with dedicated parking that has security measures in place.

Compare your costs annually: Just before you are up for renewal, check insurance costs with other providers. The older you are in Canada, the lower your premiums should become (although it is not always a case).

Bundle: If you can get home and auto insurance from the same provider, you might benefit from a better rate.

Employee discount: Ask your HR department if your employer has any insurance discounts with particular insurers. Many large companies, alumni groups and associations benefit from group insurance rates.

Winter tires: In some provinces (e.g. Quebec) winter tires are a must, but in others provinces, such as Ontario, it is optional. InsureEye’s advice is to get winter tires! The weather in Canada will make sure that you will need these at least a few times a year. An overview from Wintertpms.com provides a great overview of this topic.

Another tip: A four-wheel-drive car can be very handy in winter, especially if you live outside of a big city; but even in Toronto, a four-wheel-drive can help a lot in the winter!

Question #6: Cheap Car Insurance in Canada – What else should you know?

Accidents on your records: The more time that passes by after your last accident, the better you look in the eyes of an insurer:

- Your ticket convictions fall off after three years

- Your accidents impact your record less, year after year, for up to 20 years.

Rental car insurance: A rental car insurance rider is a good product to buy as additional protection with your auto insurance policy. It is an add-on that extends your existing individual car insurance to a rental vehicle. It costs around $20-$30/year. If you decide to get rental car insurance in a rental location, it will cost you $15-$20/day. See the difference?

Another important aspect of buying car insurance at a rental location – it probably has much lower insurance limits than your personal car insurance. Let’s say, if you have $2,000,000 liability on your personal policy, an insurance policy purchased in a rental location might only have the minimum required by law – and that’s just $200,000 in Ontario.

Rental car insurance and credit cards: Many credit cards include rental car insurance coverage, but there is something very important to know about this. It DOES NOT cover 3rd party liability, meaning that if you damage somebody’s else property, it is not covered. This type of insurance is called a damage/collision wavier, and, as opposed to a real car insurance policy, it is only good for covering scratches/damages on the rental car itself.

We hope you find this information helpful. Are you looking for cheap car insurance? We can help you find the cheapest policies in Canada.

Did you have any particular experience with car insurance in Canada after moving from abroad? Share your stories below.

Weekend Reading – Dead simple investing, selling Berkshire, household expenses, and #money stuff - My Own Advisor

March 31, 2017 at 12:21 am[…] INSURANCELLY is striving to help new drivers to Canada with this article: Cheap Car Insurance – 7 Things to Know If You Are New to Canada. […]