Welcome to your complete guide to home insurance for Sarnia. Here you will learn about home insurance premiums in Ontario, how to save money on your home insurance policy, how to choose the best policy and more. We’ll even bust some home insurance myths!

What are typical Home Insurance cost in Sarnia, Ontario?

The chart compares average renters and average homeowners insurance premiums in Ontario, and other provinces. Renters insurance is usually lower than homeowners. This is because of what each policy covers. Renters insurance only covers contents and sometimes liability. Homeowners insurance, on the other hand, covers the property, the dwelling, and a number of other perils.

Increasingly, flooding is impacting Ontario. Most insurers in Canada cover overland flooding (defined as when water enters the home from the outside due to heavy rain, rapid snow melt, etc.). However, sometimes this coverage is sold as an optional rider and/or is bundled with other coverage such as sewer backup. It also goes under different names, like overland flooding endorsement. Check your policy and talk to your insurer. This is very important coverage and you must know if you have it, if you can purchase it as an optional rider, and what the coverage details entail.

How to save on Home Insurance in Sarnia: 10 Tips

- Renovations: Renovating your house can result in lower home insurance premiums. This is because older, poorly maintained homes can have more risks like outdated plumbing or oil heating. Sometimes updating just a part of your house, such as the basement or kitchen, can lead to savings on your insurance.

- Water damages: Always ensure the home inspector has done a detailed check for water damage before you buy a house. Water entry can cause ongoing maintenance issues.

- Anti-theft protection: Some insurers, like The Personal, will offer a discount if you have a home alarm system.

- Wiring: Avoid aluminum wiring. It is very expensive to insure – that is, if you can get insurance at all for it. If you do find coverage, not only will it be very costly, you will likely have to front the costs of a full electrical inspection.

- Avoid living in dangerous locations: It costs more to insure a house in areas known for earthquake activity or in flood-prone zones.

- Mortgage insurance: You may have enough life insurance to cover the outstanding mortgage on your home. Mortgage insurance is another name for a life/critical illness and disability insurance, and it is provided by the bank. Often, the bank is the beneficiary. However, a term life policy large enough to pay off your home is usually cheaper and you can choose your beneficiary.

- Claims-free discount: Depending on the insurer, you may be eligible for a discount if you have been claims free for a set amount of time. If you do not already enjoy this discount, ask your insurer if it applies.

- Employee / Union members: IBM Canada and Research in Motion are just two examples of employers or unions that provide insurance discounts to employees or members. Check to see what your work, association, or union offers.

- Rebuilding vs. market costs: Think about rebuilding costs when choosing insurance coverage, not the market price of your house. Market price can be significantly higher than rebuilding costs. Rebuilding costs will restore your home to the condition it was in before the loss.

- Stop smoking: Smoking is a fire risk and almost always increased your premiums.

5 Elements that will increase your Home Insurance costs

- Oil-based heating: Don’t expect cheap insurance if your home has an oil heater. Insurers greatly prefer electric or forced-air gas furnaces as they are safer and more environmentally friendly.

- Home being a part of your business: The presence of business assets on the property, along with more people coming and going (as seen with a BnB or daycare) increases your liability, and your premium.

- Old house elements: Depending on the age of some building elements, like your home’s roof or if you have lead plumbing, insurance can be more expensive or even not available at all until a proper renovation is completed.

- Building frame: Wood frame homes are more likely to suffer from fire, so they are often considered less safe than concrete or brick homes. This is why wood frame houses have higher insurance rates.

- Garden and Trees: Gardens, trees, and fences could cost extra to insure, depending on your landscaping.

Sarnia – Home Insurance quotes, examples

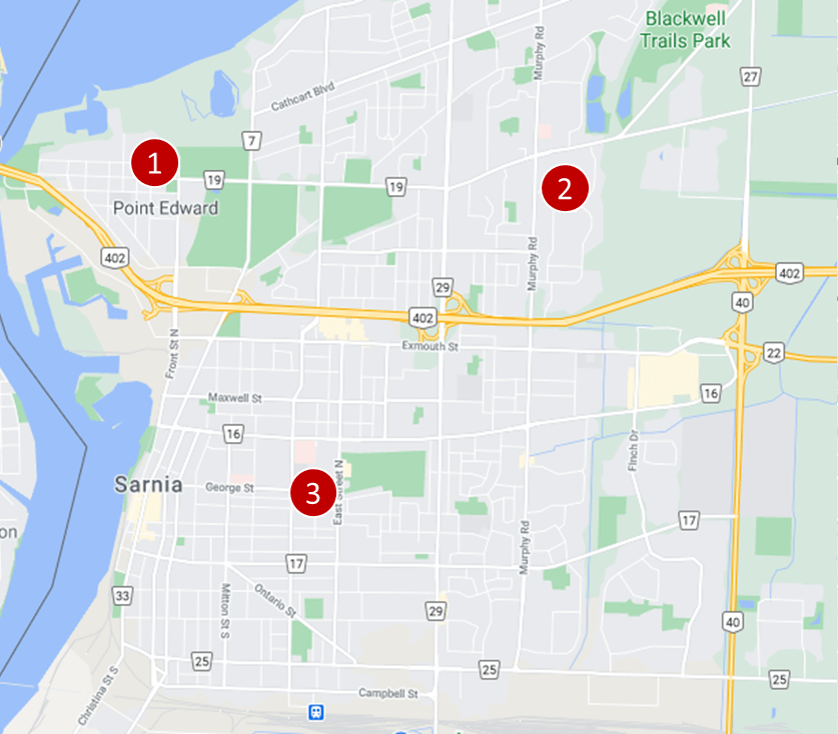

Quote #1:

Homeowners insurance for a single storey detached house about 1,000 sq. feet. The house has a built-in single garage, semi-finished basement, and brick veneer. It is located in Point Edward.

$78 per month ($936/year)

Quote #2:

Tenant home insurance for a two-storey detached brick house under 1,500 sq. feet. This house has a built-in garage for one car, pool, and no basement. It is located in Wiltshire Park neighborhood.

$34 per month ($408/year)

Quote #3:

Homeowners insurance for a two-storey detached house about 1,500 sq. feet, bundled with auto insurance. This home has an attached garage and no basement. Located on Bright St. next to Lion’s Park.

$94 per month ($1,128 /year)

5 Home Insurance myths to know

Myth #1: It is fine to overstate the value of the damage

Overstating the value of damage is a dangerous thing to do. Discrepancies are caught when the insurer does their own assessment or investigation and if you appear to be acting fraudulently your claim could be denied and your policy cancelled. If this happens it is difficult to get insurance elsewhere.

Myth #2: Home insurance automatically covers upgrades to the home or condo

Upgrades are not automatically covered. You must advise your insurance provider when you renovate or upgrade. These upgrades are added to the policy. Know ahead of time how your insurer handles upgrades.

Myth #3: If I am a tenant, my landlord’s insurance covers everything – it is his/her responsibility

As a renter you, not your landlord, are responsible for your contents and liability. In fact, your landlord can make renters insurance a condition of the lease.

Myth #4: If I make a home insurance claim, my insurance costs will go up

Sometimes a claim will not increase your costs but will simply eliminate your claims free discount.

Myth #5: If my dog bites and injures someone, my home insurance will not protect me.

I need a special insurance policy. Ensure you fill out the application honestly regarding pets and be truthful in the investigation. Bites are covered if your dog attacks and injures a third party, as long as you have been honest about the situation from the start – and as long as this is a risk covered by the policy.

Home insurance coverage depends on the type of insurance you choose:

- Tenant insurance: Covers your personal contents and liability.

- Homeowner insurance (condo): Covers the condo unit and associated upgrades (but not the condo building itself), contents (e.g. theft, damage, etc.), and liability.

- Homeowner insurance (house): Covers the entire rebuilding costs for your home, and, depending on your riders, a range of natural impacts (e.g. earthquake, flooding, snow damages, trees and garden, etc.), liability, additional structures on your land (e.g. shed, storage space, etc.).

Different home insurance companies specialize in different segments of customers (e.g. seniors, affiliated members of various organizations such as CPA, CAA, etc.), geography, types of buildings, risk types, etc. In order to find the cheapest home insurance, it is important to get a quote from as many insurers as possible and understand what exactly they offer (e.g. level of coverage, deductibles, coverage exclusions, etc.). Our insurance professionals can help you with all these questions.

Our proprietary insurance review platform has collected independent consumer reviews for different insurance and financial products since 2012 and has thousands of insurance reviews. Click here to access for free all home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with People from other parts of […]

Condo Review Platform CondoEssentials Launched

INSURANCELLY has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform People about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |