Get a Home Insurance quote now. Start saving.

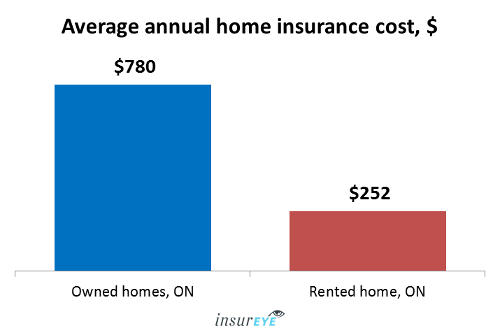

On average, homeowners pay $780 and renters pay $252, which equates to homeowners paying three times as much to protect their homes. Factors such as location, cost to rebuild the home, coverage size and additional endorsements or riders, such as earthquake or jewelry coverage, can have a big impact on what the average home insurance cost in Ontario is.

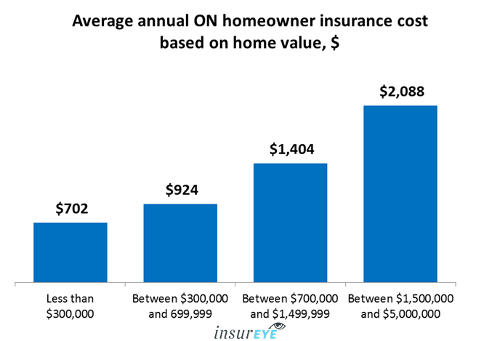

Although the market value of your home does not directly impact what you pay for insurance, it can give you an idea of what you can expect to see in terms of costs – or at least what you should plan and budget for. A home valued at under $300,000 generally sees an average home insurance cost in Ontario of $702 a year, and homes in the higher brackets, for example between $300,000 and $700,000, can expect to pay $1,000 (approximately $924) but again, the final numbers will be impacted by other factors.

Obviously the more expensive the home is, the more insurance you will pay, but this isn’t a reflection of market value, it’s often a straight numbers game. A more expensive home means a more expensive home to rebuild – or a home with more expensive attributes to protect. If your home falls in the $700,000 to $1.5 million range, it’s reasonable to see average home insurance cost in Ontario hit the $1400 mark annually, and $2000+ for homes in the $1.5 to $5 million range.

Another section of our website provides additional info about condo insurance rates and quoting process.

Provincial differences among average home insurance costs

As with many things, home insurance costs vary by province. Why is this? Each province has its own unique geographical challenges and dangers. Average home insurance costs in Ontario aren’t typically impacted by things like earthquake coverage, because they aren’t really an issue there. The same cannot be said of British Columbia though, and many homeowners there do purchase this coverage because it is a real threat.

In Canada, overland flooding is a separate area for insurance and insurers aren’t typically willing to cover this risk.

Variables in average home insurance costs in Ontario

[home_insurance_square_widget]There are certain factors and features that can increase a home’s insurance cost as well. These are important to consider when purchasing a home, and include things like fireplaces or woodstoves, swimming pools, oil-based heating systems, old wiring, commercial zoning, old pipes and other outdated features, like old roofing. Your garden and tree situation can have an impact too, with large trees that pose the risk of falling on the home increasing your average cost of home insurance in Ontario.All of these home features, while often desirable, increase the risk of damage to the home or liability issues in the event of a third-party accident or incident.

We think it’s incredibly important that homeowners understand the average home insurance costs in Ontario, and use that information to make solid, informed decisions. If you are looking for home insurance, contact us today to learn more.

If you are a builder, construction company or a construction contractor, you might want to check our section on builders risk insurance that includes an overview of risks covered by this insurance and also tips to consider for a proper builders risk coverage.