Toronto condo market overview

Toronto condos have outpaced all other market segments in the housing market this year. Even when detached houses, semi-detached and townhouses were sinking in price earlier in 2018, condos experienced double digit growth.

At the end of the summers the numbers were similar. Although other types of MLS listings in Toronto rebounded, condos sustained their growth and are up 8.3 per cent this August year-over-year to $585,355, while detached houses are up just 4.9 per cent to $1,244,275.

That’s good for those who are already settled inside their glass boxes in the sky, but it’s scary for prospective buyers who are losing hope of ever setting foot on the property ladder.

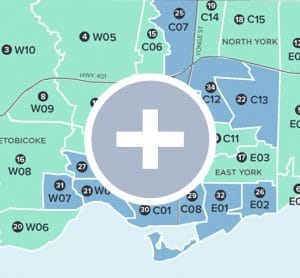

Our friends at Zoocasa wanted to identify the Toronto neighbourhoods with the greatest condo affordability. They used TREB data to determine the average condo price in each area and Statistics Canada to find out the median income of Toronto households.

The condo situation is dire for single- and dual-income buyers

Single-income earners in Toronto only earn a median income of $39,650. Based on that income and the typical 20 per cent down payment it’s unlikely they would ever be able to qualify for financing. The maximum mortgage amount they would be able to get is $247,657, less than they need to buy in the cheapest neighbourhood of Westhill and Centennial Scarborough.

It looks like the only way to get on the property ladder is to save more than 20 per cent for a downpayment, or become part of a two-or-more income household.

Dual or more income households have a median take home pay of $96,294, which opens up their options for buying a condo in Toronto. Assuming a 20-per-cent down payment, this household qualifies for a maximum mortgage amount of $591,347 – attainable in 18 of the 35 examined neighbourhoods.

Still, neither single, nor dual-income households would qualify for a mortgage for a condo in any downtown Toronto neighbourhood with just a 20-per-cent down payment.

Possible solutions for getting cheaper condos

Unsurprisingly, condos for sale in downtown Toronto are all more than the city average. But move just outside the spine of the city, into the outer boroughs and you’ll find multiple neighbourhoods where condos are a bargain. The east-end in particular has multiple areas in which a household earning less than $60,000 can afford a condo. North York also has many family friendly neighbourhoods, like Yorkdale-Glen Park and the Bathurst Manor, which are options for those earning less than $80,000.

Check out the infographic below to see the entire map:

Zoocasa.com is a leading real estate company that combines online search tools and a full-service brokerage to empower People to buy orsell their homes faster, easier and more successfully. Home buyers can browse real estate listings on the website or the free iOS app.