Looking for home insurance in Hamilton? Welcome to our complete home insurance guide. This is the place to learn about everything from average premiums to the factors that affect your price and policy.

What are average Home Insurance cost in Hamilton?

The chart displays average renters and homeowners insurance in Hamilton, in Ontario, and in other provinces. Have you noticed that renters insurance rates are lower than homeowners rates? This is because renter’s insurance usually only covers the contents and sometimes liability, but homeowners insurance covers much more. Homeowner’s insurance in Hamilton covers the dwelling, the property, and a variety of other risks like liability and some natural disasters.

Lately, flooding has become an issue that is increasingly impacting Ontario. Most insurers in Canada cover overland flooding, which is water entry from outside your home (via river surge, excessive rain, etc.). It is always best to check with your insurer to see if this is part of your main policy, or if you must purchase a rider. Sometimes it is sold under a different name, such as “overland flooding endorsement,” and sometimes it is bundled with even more protection, such as sewer backup.

How to save on Home Insurance in Hamilton: 10 Tips

- Change your content coverage: If you live in an apartment or condo, check your content coverage limits. If your belongings don’t add up to the typical $250,000 limit, reduce the coverage to save on your premium.

- Plumbing insulation: Reduce or avoid unnecessary claims by insulating your pipes. This helps protects them from freezing or busting during the winter.

- Water damage: Once you have water damage, you can have ongoing issues with mold and rot. Make sure your home inspector takes a good look around for signs of previous water damage.

- Wiring: Ensure your home has approved wiring. Aluminum wiring, for example, is out of date and can cause fires. It is very expensive to insure. In fact, few insurers will even cover this risk and those that do will ask you to provide a full electrical inspection – at your own cost.

- Anti-theft protection: Some insurers, like The Personal, offer a discount if you have a monitored home alarm system.

- Annual vs. monthly payments: Insurers save time and money on administration costs when they process annual payments. Switch from monthly to annual payments to get a discount on your premium.

- Hydrants and fire-stations: You are safer if you are closer to a fire hydrant or fire station. This lowers your risk and can lower your premium too. Ask your insurer if this proximity can get you a discount.

- Avoid living in dangerous locations: Locations known to be prone to flooding, earthquakes, or other natural disasters raise your premium.

- Dependent students: If your child has moved out and has their own apartment but is still a dependent, your policy may cover them at no extra charge. Desjardins is one insurer with this on their policy. Ask your insurer if this applies to your situation.

- Business Insurance: Check out the difference between home vs. business insurance. Those working from home but without significant business assets on the property may find home, not business insurance, to be the better option.

5 Elements that will increase your Home Insurance costs

- Oil-based heating: Not only are oil based heaters inefficient, they have a higher risk of starting a fire. They are also an environmental hazard. Insurers prefer electric or forced-air gas furnaces.

- Old house elements: Worn out shingles, old plumbing – if your home is old and not updated, it can be more expensive to insure until a proper renovation is completed.

- Building frame: Concrete homes suffer less damage than wood frame homes, which is why wood frames homes can be more expensive to insure.

- Basement: During a flood, pipe burst, or sewage backup, water flows down. That is bad news for finished basements! This can sometimes drive up insurance costs because finished basements are more expensive to insure.

- Expensive items: Beautiful jewellery, wine collections, works of art, music or sports equipment – these can raise your policy price because they can be higher than your contents insurance maximum. Check with your insurer to see if you need a rider for your expensive items.

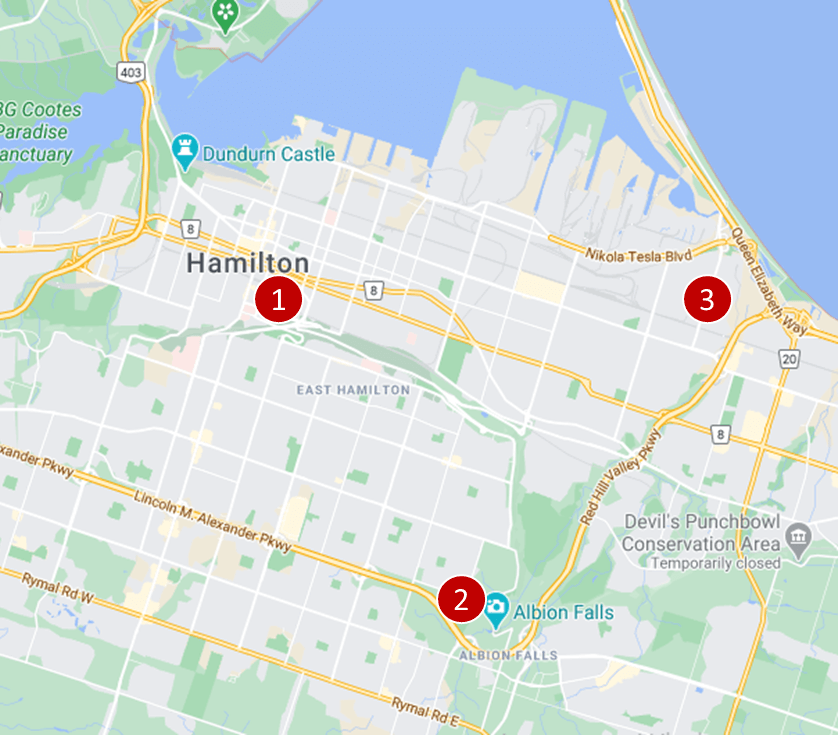

Hamilton – Home Insurance quotes, examples

Hamilton home insurance quote #1:

Homeowners insurance for a 2-bedroom condo under 1,000 sq. feet in a high-rise building. The occupants are non-smokers. There is a monitored burglar alarm and the owners do not have a mortgage. The building is located in Corktown close to Woolverton Park.

Price: $35 per month ($420/year)

Hamilton home insurance quote #2:

Homeowners insurance for a 2-storey new detached brick house, about 1,500 square feet, located next to Trenholme Park. This house has a single built-in garage and no basement. The home insurance policy is bundled with car insurance.

price: $69 per month ($828/year)

Hamilton home insurance quote #3: Tenant home insurance for a 1-storey detached house under 1,000 sq. feet with a single attached garage. The house has a new roof and no basement. Located in the Parkview East area.

Price: $27 per month ($324/year)

7 Home Insurance myths to know

Myth #1: The market value of my house is covered by home insurance

The rebuilding/replacement value, not the market value, of the home is coved. This may be lower than the market value. The purpose of insurance is to rebuild your home to the condition it was before the loss. Additionally, rebuilding does not cover the value of the land, which is also insured. For example, should your house burn down, insurance can rebuild your home but there is no need to “replace” the land it sits on. Insurance can, however, include extra protection such as the clean up cost for a fire or other disaster.

Myth #2: There is no penalty to overstating the value of the damage

Each claim is carefully assessed and if you are caught overstating the value of the damage, your claim can be denied, and your policy cancelled. Once that happens it is very difficult to quality for insurance elsewhere.

Myth #3: Older homes are much less expensive to insure

The opposite is usually true! If the older home has old components such as plumbing and wiring, there is a greater chance that something will go wrong or break down. Older homes are also more likely to fail electrical or plumbing inspections than newer homes with upgraded, safer, materials.

Myth #4: Insurers will substitute lost/damaged items with new ones

This is entirely dependent on if your policy states cash or replacement value for your items.

Myth #5: Condominium corporations provide insurance that covers my condo

The condo corporation’s insurance only covers the building envelope, that is, the overall building structure, its exterior finishes, roof, windows and common areas like elevators and hallways. It does not cover your unit’s contents, theft, or third party liability.

Myth #6: Claims increase my premium

This is not always true. Sometimes you get a “pass” on your first claim, or simply lose your zero claim discount.

Myth #7: If I am away on vacation, my house is still protected

Your policy outlines the precaution you must take when you are on an extended vacation. You may need to empty the water pipes or ensure the heating cycle is going. You may also need to have someone visit your property every three to seven days. Your policy outlines what is expected when you are not on the premises due to business or leisure travel. Ensure you know what the policy entails so you can avoid things like frozen pipes or theft resulting in a claim. If you fail to follow the precautions listed, your claim can be denied.

Frequently Asked Questions (FAQ): Home Insurance in Hamilton

What does Home Insurance cover in Hamilton?

Home insurance coverage in Hamilton, around Ontario, and across Canada, depends on the type of insurance you need. Here is a quick overview.

- Tenant insurance: Typically covers contents and liability.

- Homeowners insurance (condo): Covers the condo unit and upgrades but not the condo building itself as the building envelope is covered by the condo corporation. Your policy also covers contents (e.g. theft, damage, etc.) and liability.

- Homeowners insurance (house): This is the most comprehensive coverage. It includes, the entire rebuilding costs for your property, a wide range of natural impacts depending on your riders (e.g. earthquake, flooding, snow damages, etc.), liability, tree and garden (depending on riders), and some additional structures on your land like your shed for extra storage.

Who has the best Home Insurance in Hamilton?

Home insurance can specialize in different segments, such as catering mainly to seniors, members of affiliated groups, rural properties, specific risks, etc. To find the cheapest home insurance in Hamilton, you must get quotes from as many insurers as possible. You must also understand what level of coverage is offered, the deductibles, any exclusions, riders offered, and more. Our insurance professionals are happy to help you find quotes and answer your questions.

How much is home insurance in Hamilton?

The cost of home insurance in Hamilton depends on many different factors, from the type of insurance you need (for a single family home, condo, or rented property) to the age of the home – and more. Here is a quick overview.

- Tenant insurance is often the cheapest. For a condo unit it can be as low as $15/month.

- Homeowners insurance for a condo is not very expensive because it only covers your condo unit, upgrades, contents and liability. You typically pay around $20-$50/month to insure a condo.

- Homeowners insurance for a house can start at $50/month and go as high as several hundred dollars per month depending on your property. Things that affect the premium include the presence of a basement, the geographical location (for things like flooding or earthquake risks), the condition of the home, and if elements like the roof or wiring are upgraded.

Home Insurance in Hamilton – Reviews: where to find them?

Since 2012, our proprietary insurance review platform has collected independent consumer reviews for a wide variety of insurance and financial products. Please click here for free access to all our home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with People from other parts of […]

Condo Review Platform CondoEssentials Launched

INSURANCELLY has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform People about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |